Your Identity is Connected to Your Credit

Our credit is a pretty important part of our personal identity, but many people don’t realize that it’s not just a metaphor. We’re living in a digital age and it’s not uncommon to have your credit card number stolen or for that matter, your identity. The only reason for either of these to occur is to perpetrate some kind of fraud. It’s as simple as that.

If someone steals your identity, they may take out credit cards or commit to other financial obligations that put you on the hook for the bill. Nobody wants that! There are programs and services that you can purchase to help protect your identity, but I’m not going to get into those. I want to point out one thing you can do regularly to monitor your credit for things that don’t belong and the only costs are your time and attention.

Request a free credit report.

You’re allowed to run a report from AnnualCreditReport.com one time every twelve months for EACH of the credit agencies: Equifax, Experian and TransUnion. How you do it is up to you. You can check all three at the same time or you can space them out over the calendar. We recommend that you check a different one every four months, thus minimizing the duration between the times you are looking at your credit.

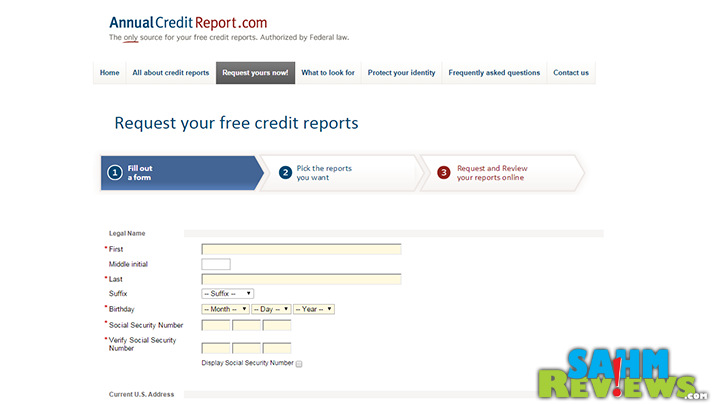

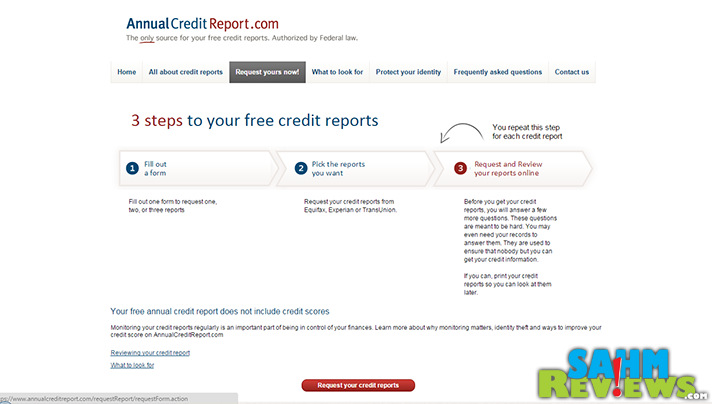

The process is very simple and can be done online in a few minutes. I set reminders on my computer to prompt me to check. I also maintain a file with prior reports in case I want to compare anything. To begin, log onto AnnualCreditReport.com and select the “request a report” tab on the top. Fill out the form with the personal information it requests.

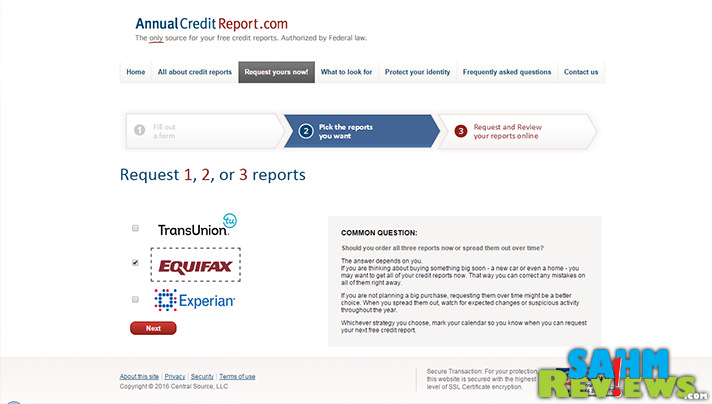

Next, select which agency you want to research. This is where you can decide whether you want to check only one agency or more. As I said, if you only check one every four months, you’ll have a better chance of catching irregularities sooner. For example, if you run reports all at the same time in January and something happens to your account in February, you won’t be logging on until the following January to notice it.

There is a prompt to pay a fee to get your actual credit score as well. Unless you have a major concern (or curiosity), save the money. With so many credit cards such as Discover offering access to your credit score through their website or app, there’s no reason to pay extra for it at this time.

As a verification process, you will be prompted to answer additional questions to confirm you are who you say you are. Examples of some of the more detailed questions might include prior addresses, mortgage amounts or phone numbers. Don’t stress too much about it as the questions are multiple choice.

Once you are able to run the report, sift through it with a fine-toothed digital comb to match up all the activity to what you know you have. Keep in mind that any open accounts you have will be reflected. As an example, the first time I ran our report, I was shocked to see an unknown account. Upon investigation, I discovered it was valid. I had forgotten we established an account with Best Buy to purchase appliances. While I had paid off the account, I hadn’t actually closed it.

See an unusual bank name but the rest of the information matches one of your known debts? It’s not uncommon for accounts to be sold to new financial institutions. Take this opportunity to close unneeded accounts and confirm that transferred ones are appropriately marked are closed and paid. Once you have identified each account, double check that payments have been recording correctly and there are no fraudulent charges or accounts occurring then you’re done!

That’s all there is to it! In today’s digital age, the more proactive you can be to protect your identity and your credit, the better off you’ll be. If you don’t do it, who will?

When was the last time you checked your credit records?

I’ve always checked mine at least once a year, but I haven’t done it in about 6 months.

The hubs has been working on our credit this year but I’m not sure what he has been using for that. I will definitely have to show him this since he has become a bit obsessed with it! Thanks for sharing.

Idenity theft is real and pretty scary. My husband keeps reminding my son not to do anything on his computer that would help a thief.

This is a very serious and important topic to be discussed. Really appreciate you sharing this post. Thanks for sharing!

Credit is so important! We have been working hard on bettering ours for the past 3 years and it’s paying off! …literally 😉

This is a great reminder. I try to check mine at least once a year but I like your strategy of setting a timer to go off every 4 months to check it. Great post!

My husband works in information security and he always has me paranoid

I always check within 3 months. Thanks for sharing this informative post with us.

My hubby keeps a close key on our credit. I had my credit card stolen once, which was really annoying, to say the least.

It is scary how much identity theft happens these days, and so easily, it seems. Thanks for such a comprehensive post. I frequently check hubby’s and my credit through Credit Karma (yes, really free credit check), and also free through our Capital One accounts.